The Harmon Murphy Group

Experience You Can Trust

With over 3,000 homes sold and 11+ years as a team, The Harmon Murphy Group has the expertise to guide you through every step of the buying process. Averaging 200–250 sales per year, we’ve helped thousands of clients navigate the market with confidence.

Proven experience. Local knowledge. Trusted by 3,000+ buyers and sellers.

Why Buyers Choose Us

When you're buying a home, the right agent makes all the difference. Here's what sets The Harmon Murphy Group apart:

Hyper-Local Expertise

We know the neighborhoods, school zones, and market trends that matter.

Fast, Clear Communication

We respond quickly and keep you informed every step of the way.

Top-Tier Negotiation Skills

We help you win the home you want, on your terms.

Full Service

Support

From pre-approval to closing, we coordinate every detail so you don’t have to.

Trusted

Network

Lenders, inspectors, contractors—we’ve built strong local partnerships to support your journey.

Get Pre-Approved

Your preferred lender will work closely with you to determine what monthly payment you can comfortably afford. Pre-approval allows us to move quickly when we find the right house.

Explore the differences between the four most common loan types here:

Conventional

A conventional loan is a mortgage that is not backed by any government agency and typically requires a higher credit score and down payment, but offers competitive rates and flexible terms.

FHA

An FHA loan is a government-backed mortgage insured by the Federal Housing Administration, designed to help first-time homebuyers and those with lower credit scores by offering lower down payments and more lenient credit requirements.

VA

A VA loan is a mortgage guaranteed by the Department of Veterans Affairs, exclusively for veterans, active-duty service members, and certain military spouses, offering no down payment and favorable terms.

USDA

A USDA loan is a rural development mortgage provided by the United States Department of Agriculture, aimed at low-to-moderate income buyers in eligible rural areas, with no down payment and lower interest rates.

Explore Creative

Financing Solutions

Gift Funding

Family members, non-profit agencies, non-occupant co-borrowers, local state and provincial agencies, domestic partners, and trade unions are all potential contributors. Remember to gather proper documentation, as lenders often require confirmation that the funds are a genuine gift rather than a loan.

Non-Occupant Co-Borrowers

Non-occupant co-borrowing pairs a financially stronger co-borrower with a homebuyer, enhancing the application for better approval odds and favorable terms. Ideal for first-time buyers or those who may not meet financial criteria independently.

Using a 401k

Some employers allow employees to borrow from their 401(k) for purposes like a real estate down payment. Repayment terms are usually five years, potentially longer for home purchases. If an individual leaves their job, the outstanding loan balance becomes due immediately, emphasizing the importance of careful consideration.

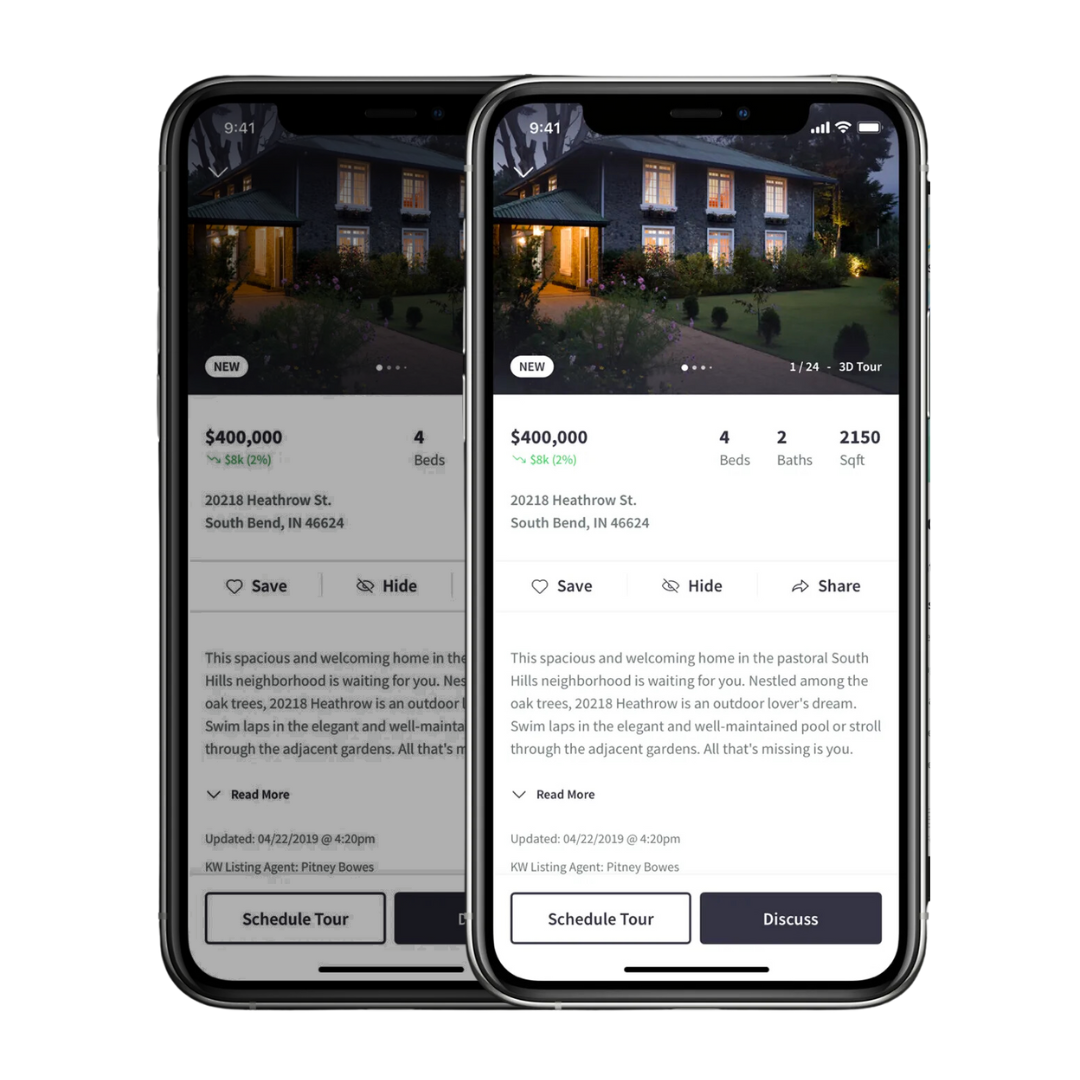

Start Your Search

Download the KW App for an

Advanced Search Experience.

Finding the right home to meet your needs is our priority, and we are here to help! The first step in buying a new home is for us to identify the neighborhoods you want to live in. Save your favorite homes, then add them to a collection.

Search by neighborhood or school district

See what the neighbors say

Save your favorites and hide what you don’t

Review upcoming open houses

Calculate estimated monthly payments

See price and tax history

See public school ratings

Review transit and commute times

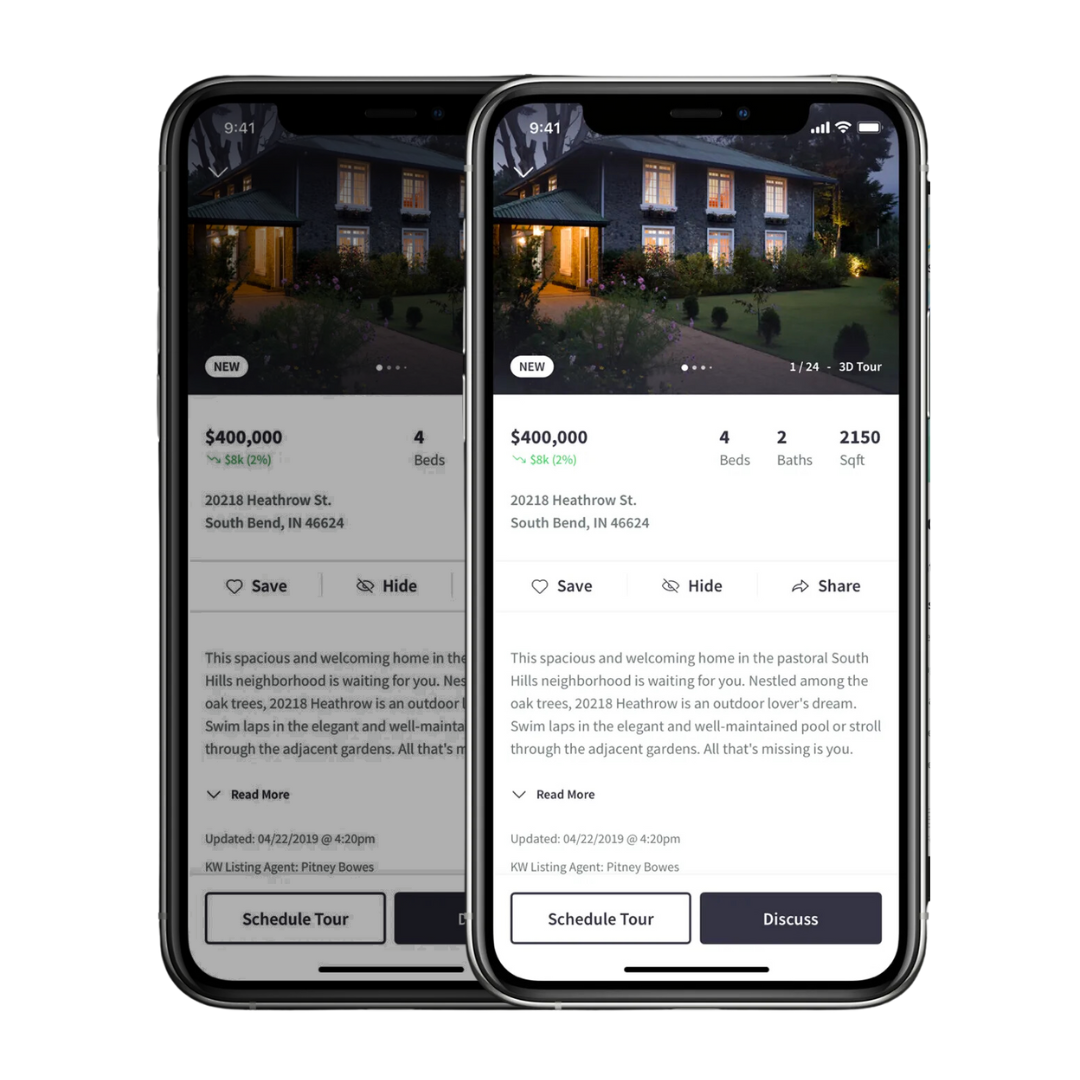

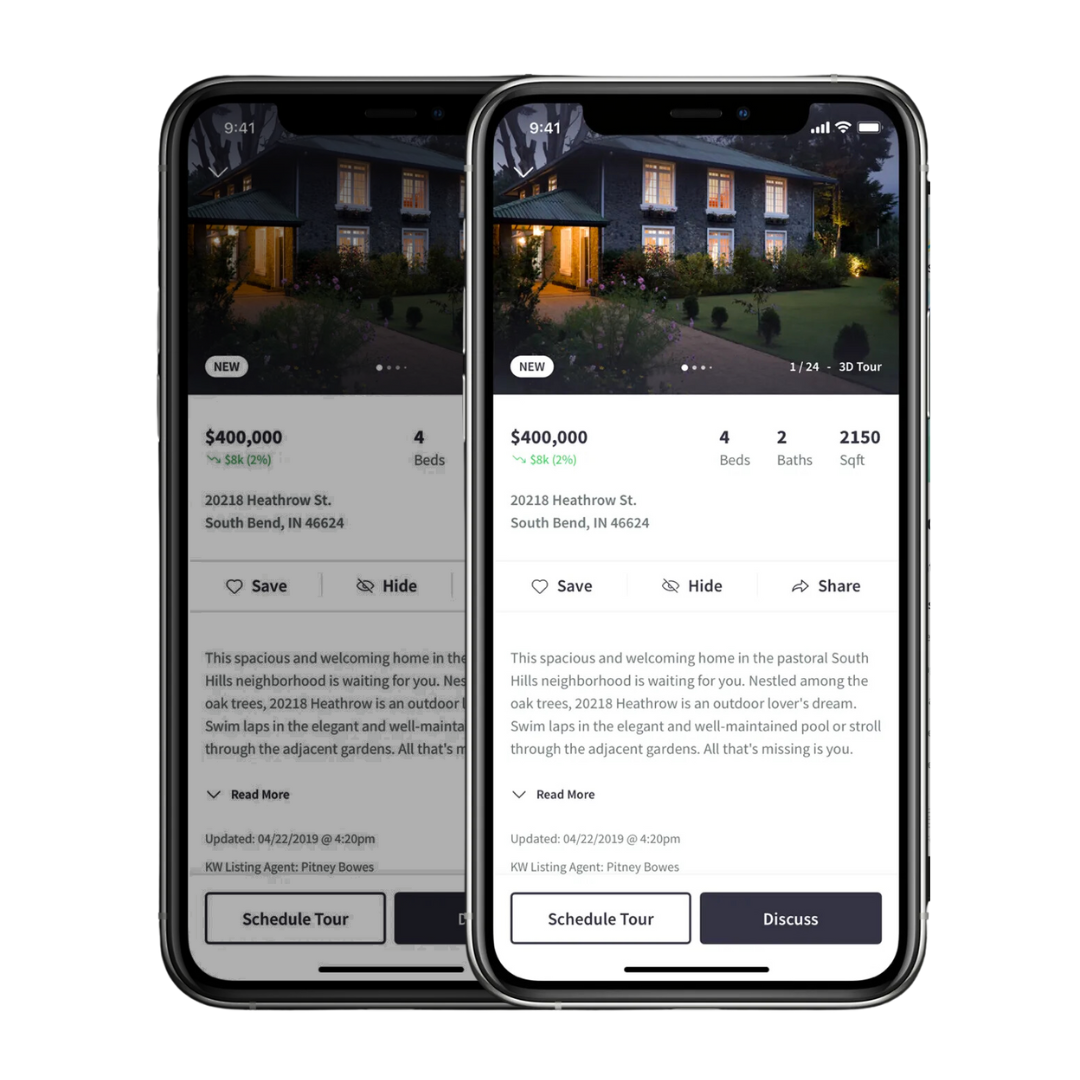

Start Your Search

Download the KW App for an Advanced Search Experience.

Finding the right home to meet your needs is our priority, and we are here to

help! The first step in buying a new home is for us to identify the neighborhoods

you want to live in. Save your favorite homes, then add them to a collection.

Search by neighborhood or school district

See what the neighbors say

Save your favorites and hide what you don’t

Review upcoming open houses

Calculate estimated monthly payments

See price and tax history

See public school ratings

Review transit and commute times

Closing Day Checklist

Bring a valid, government-issued photo ID

Double check closing disclosure for accuracy

Wire transfer exact amount to title company -

call title company to verify wiring instructions

Obtain keys, garage door openers, and/or security codes to the property once the closing funds have been received and all documents signed

Setup utilities, change mailing address, and arrange services such as lawn care or pool maintenance

From Clients to Family

We believe in creating lasting connections that extend far beyond transactions. At The Harmon Murphy Group, our commitment to our clients doesn't end at the closing table. We pride ourselves on building enduring relationships, where you're not just a client, but a valued member of our HMG family!

Touring Homes

Refining your “WANTS” and “NEEDS”

list will help us identify what’s most important to you, including both the location and the house itself. Once we narrow your list, we’ll plan an itinerary together.

As your trusted partner for your home search, feel free to reach out at any time should you have any questions about any of the homes we tour.

Financial

Are you paying cash or will you be obtaining a mortgage? If cash, what is your budget? If mortgage, what monthly payment are you comfortable with?

Timing

Ideally, when would you prefer to move into your new home?

Location

Are there specific neighborhoods or areas you are interested in? What factors are important to you in terms of location (e.g., proximity to work, schools, public transportation)?

Property Details

What type of property are you looking for (e.g., single-family home, condo, townhouse)? What are your must-have features in a home (e.g., number of bedrooms, bathrooms, yard space)? Are there any deal-breakers or specific things you want to avoid?

Lifestyle Preferences

Are there specific amenities or community features that are important to you?

Touring Homes

Refining your “WANTS” and “NEEDS”

list will help us identify what’s most important to you, including both the location and the house itself. Once we narrow your list, we’ll plan an itinerary together.

As your trusted partner for your home search, feel free to reach out at any time should you have any questions about any of the homes we tour.

Financial

Are you paying cash or will you be obtaining a mortgage? If cash, what is your budget? If mortgage, what monthly payment are you comfortable with?

Timing

Ideally, when would you prefer to move into your new home?

Location

Are there specific neighborhoods or areas you are interested in? What factors are important to you in terms of location (e.g., proximity to work, schools, public transportation)?

Property Details

What type of property are you looking for (e.g., single-family home, condo, townhouse)? What are your must-have features in a home (e.g., number of bedrooms, bathrooms, yard space)? Are there any deal-breakers or specific things you want to avoid?

Lifestyle Preferences

Are there specific amenities or community features that are important to you?