Seller Contributions

[OFFER TO PAY X IN CLOSING COSTS]

The seller provides financial assistance to the buyer, typically in the form of covering a portion of the buyer's closing costs or other expenses related to the property purchase.

Learn More About

Each Strategy Below:

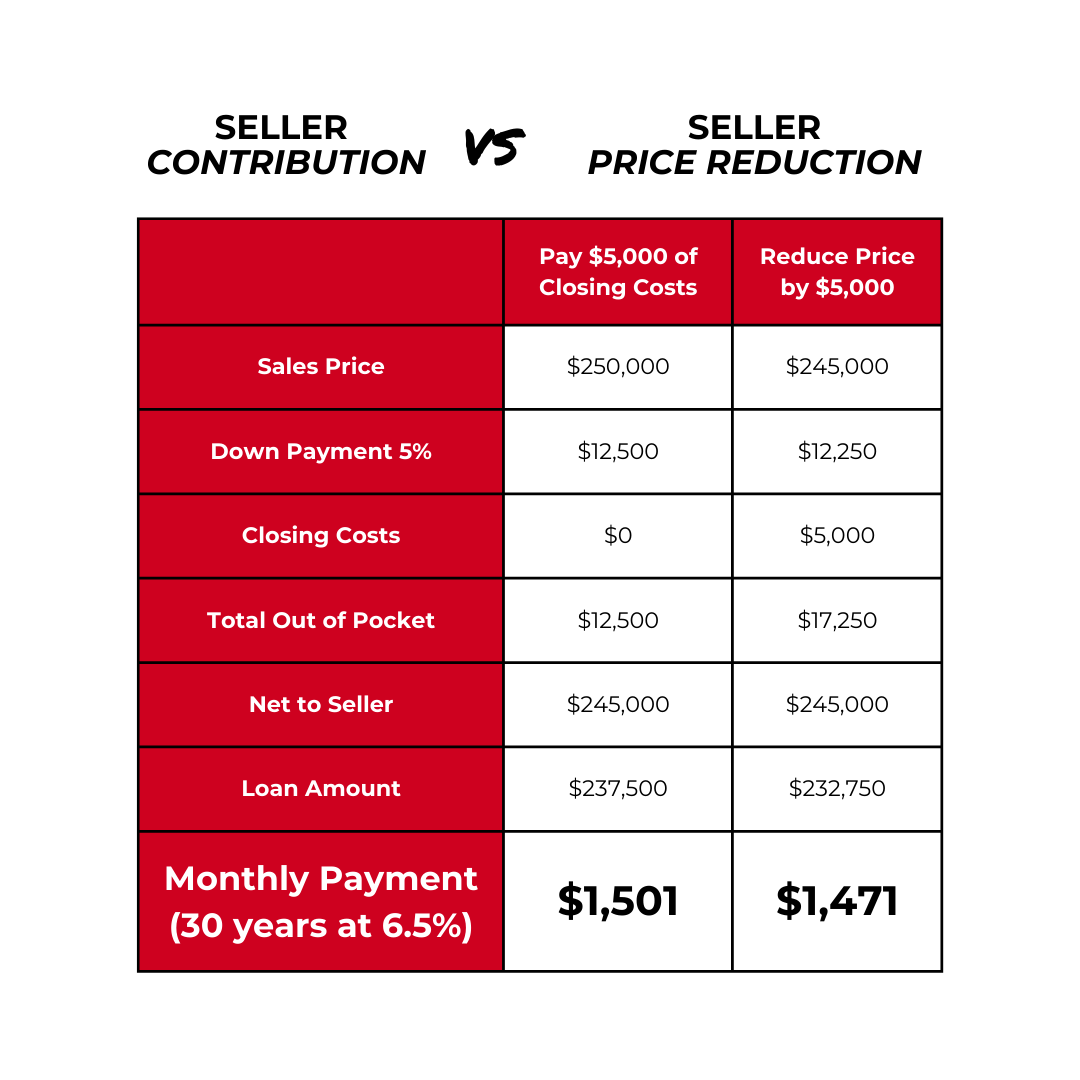

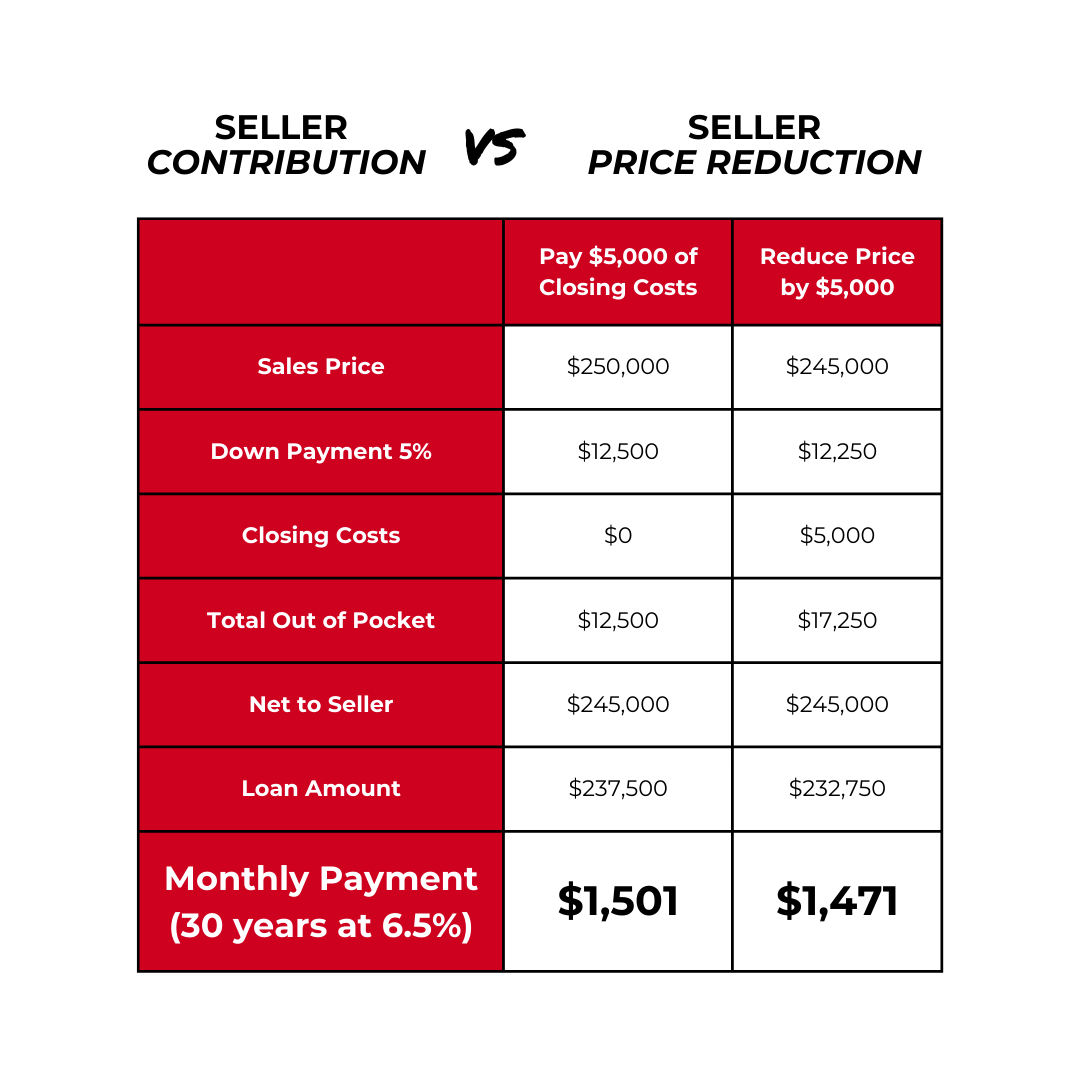

SELLER CONTRIBUTIONS

[OFFER TO PAY X IN CLOSING COSTS]The seller provides financial assistance to the buyer, typically in the form of covering a portion of the buyer's closing costs or other expenses related to the property purchase.

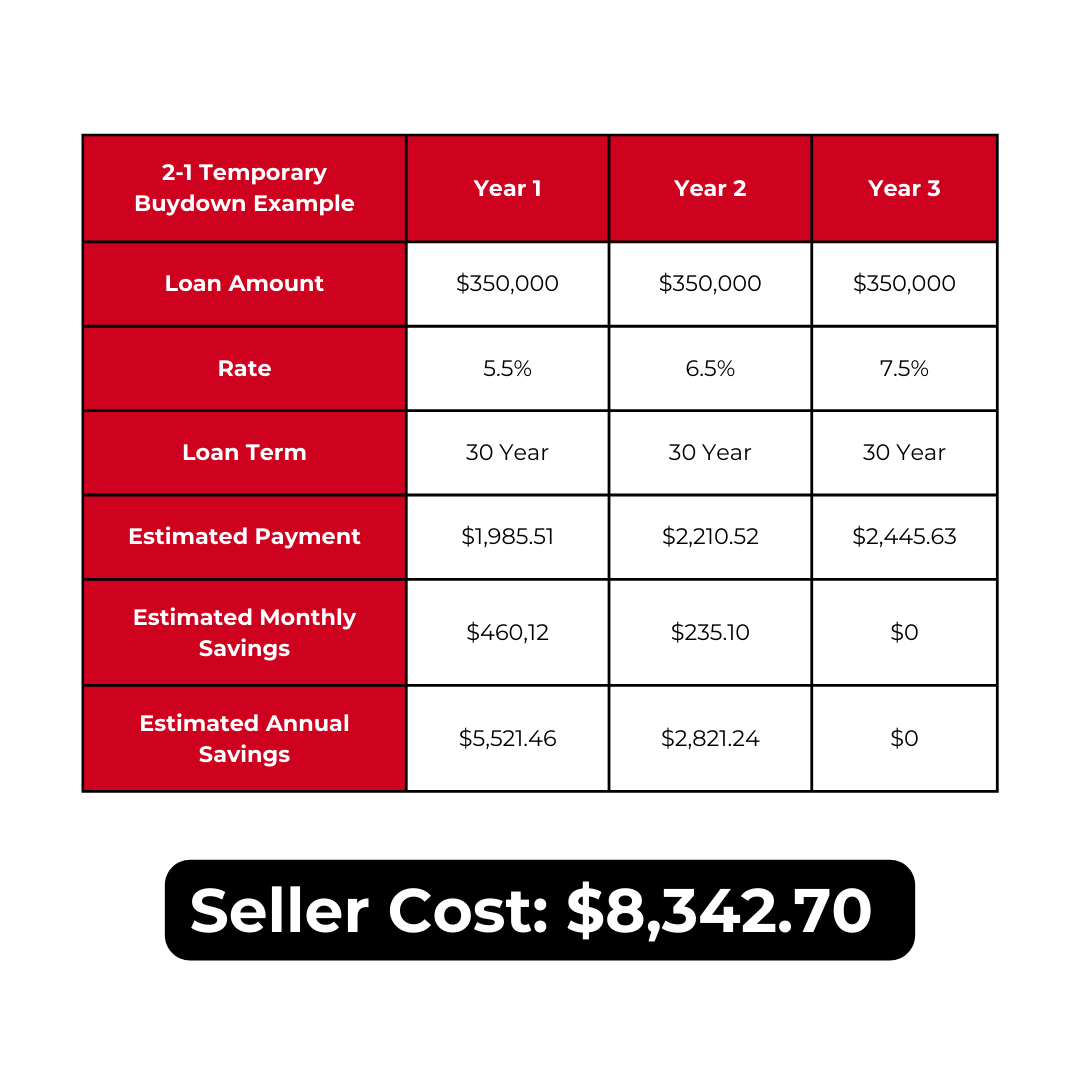

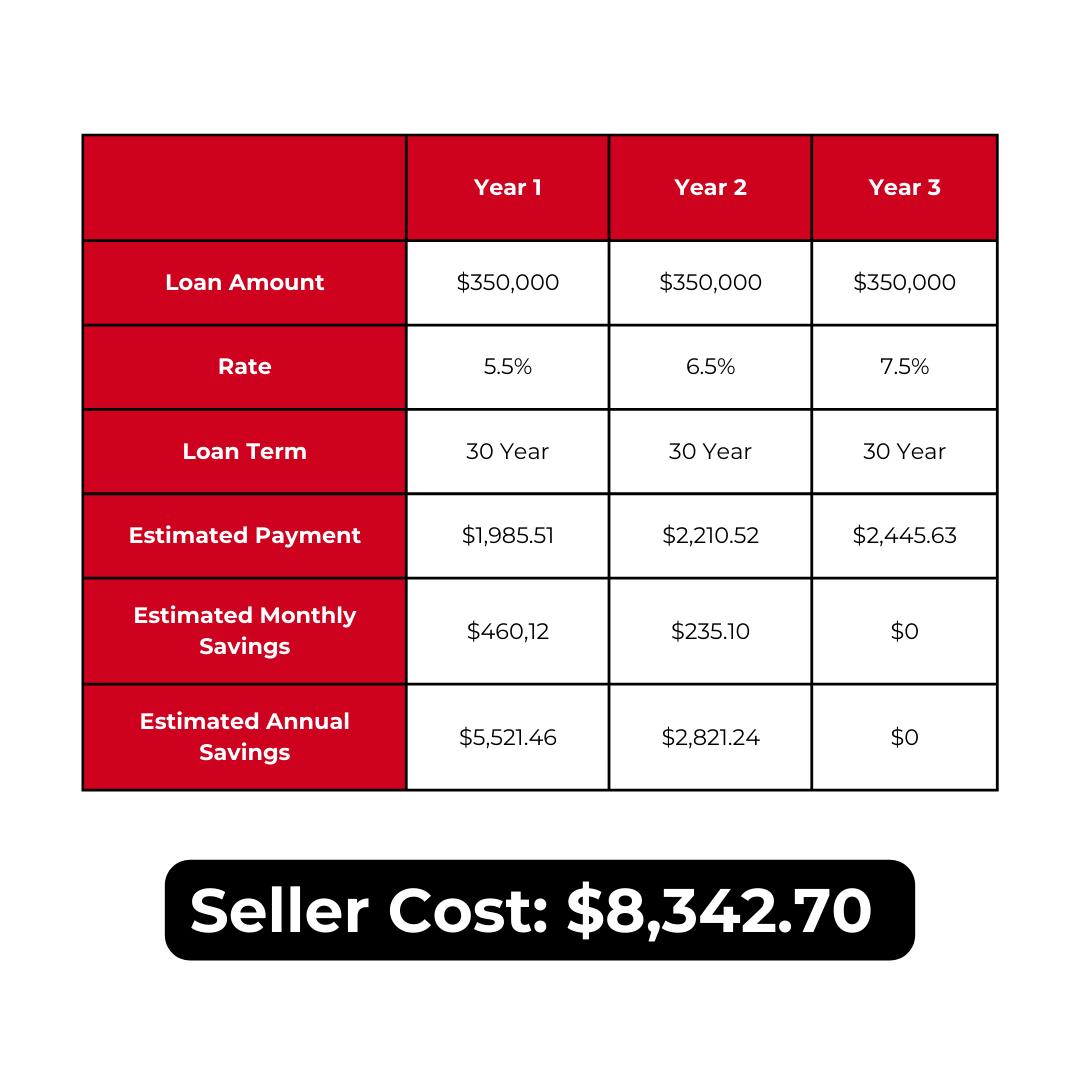

SELLER-FUNDED BUYDOWNS

The seller contributes upfront funds to reduce the borrower's mortgage interest rate over the life of the loan, resulting in lower monthly payments for the buyer. The example below demonstrates a 2-1 buydown example on a $350,000 home.

ASSUMABLE MORTGAGES

An assumable mortgage allows a buyer to take over the existing mortgage terms and payments from the seller.

OWNER FINANCING

The property seller acts as the lender, allowing the buyer to make payments directly to them over an agreed-upon period, bypassing traditional mortgage lenders. Note: the seller must own the home free and clear with no mortgage.

CONTRACT FOR DEED

This works just like owner financing with one extremely important exception - ownership doesn't change hands until the entire sales price is paid in full. The process is similar to an auto loan where the car only belongs to the buyer after all payments have been made.

LEASE OPTION/LEASE PURCHASE

A tenant has the option to purchase the property at a predetermined price during or at the end of the lease term, providing flexibility for potential buyers to test the property before committing to ownership. Lease option gives the buyer an exclusive "option" to purchase the home at an agreed upon price after renting for a certain period of time. A lease purchase specifies that the buyer WILL purchase the home at the end of the agreed upon term.

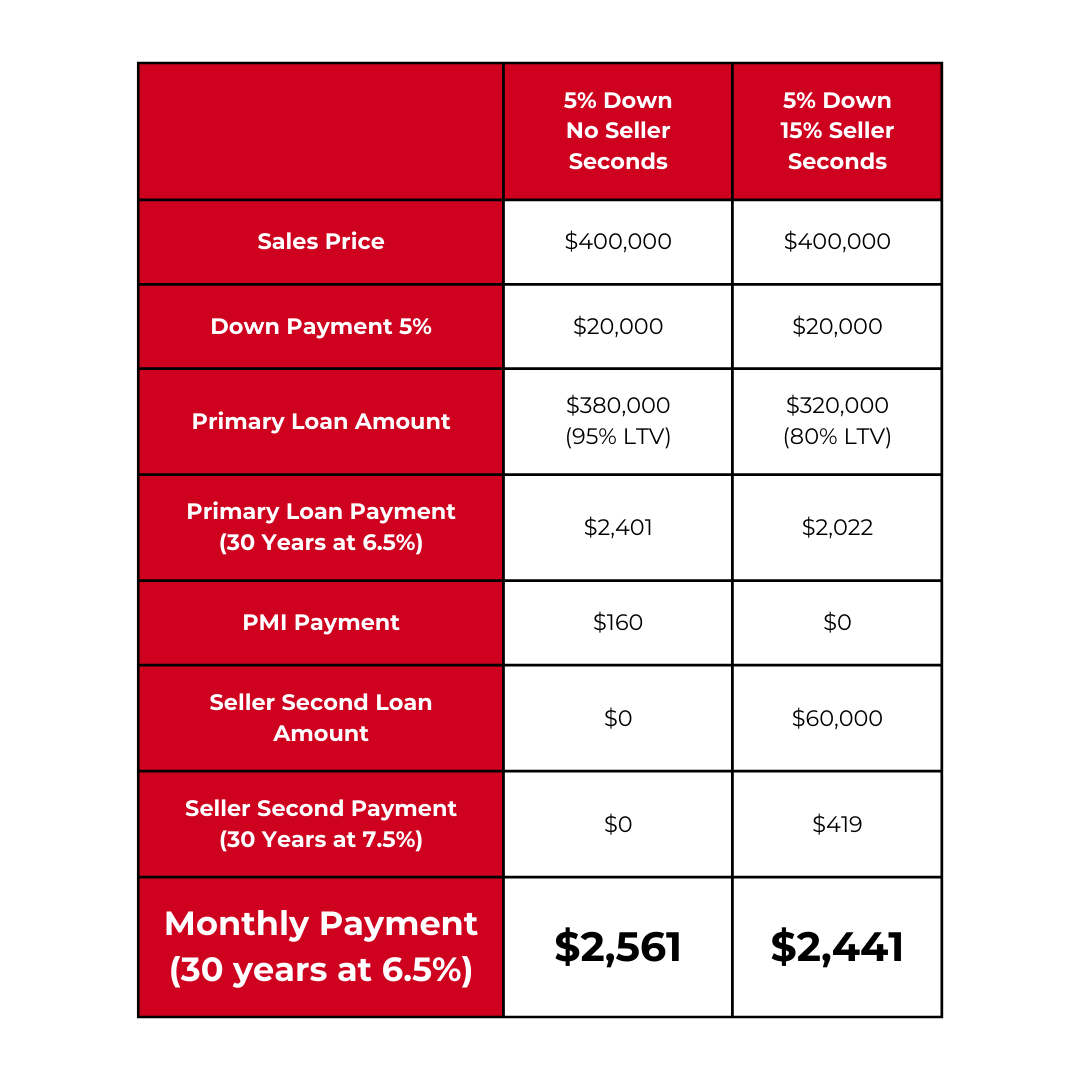

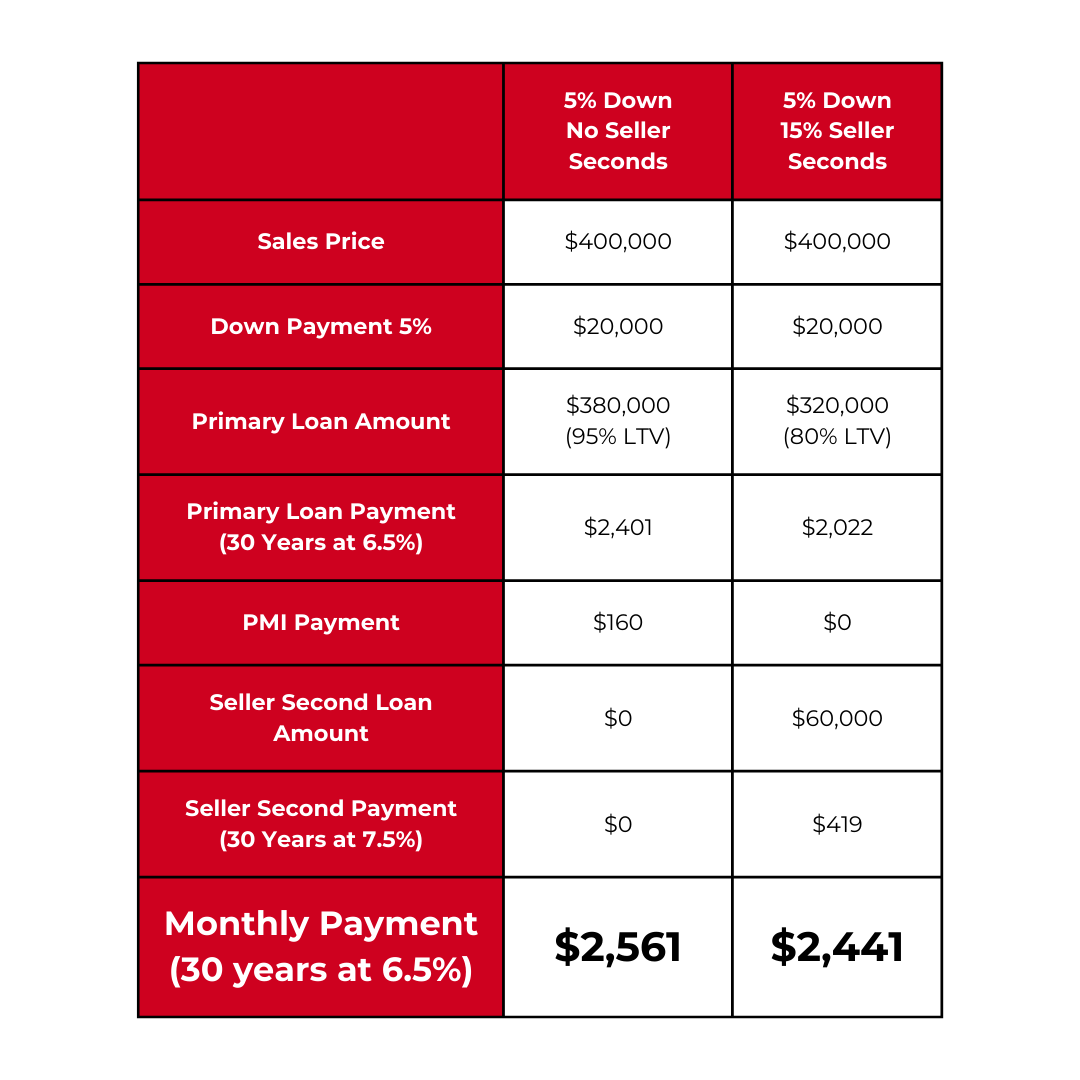

SELLER SECONDS

The seller extends a second mortgage or loan to the buyer in addition to the primary mortgage, providing additional funds to facilitate the property purchase. Like any second loan, the interest rates are usually higher to compensate for the increased risk. Seller seconds can help the buyer avoid private mortgage insurance (PMI), allow a smaller down payment, lower monthly payments, or even higher interest rates.

Video Explanations From Our YouTube:

Seller-Funded

Permanent Buydown

The seller contributes upfront funds to reduce the borrower's mortgage interest rate over the life of the loan, resulting in lower monthly payments for the buyer.

Seller-Funded

Temporary Buydown

The seller provides upfront funds to temporarily lower the borrower's mortgage interest rate during the initial years of the loan, leading to reduced monthly payments for the buyer during that specified period.

Assumable Mortgage

An assumable mortgage allows a buyer to take over the existing mortgage terms and payments from the seller.

Lease Option &

Lease Purchase

A tenant has the option to purchase the property at a predetermined price during or at the end of the lease term, providing flexibility for potential buyers to test the property before committing to ownership.

Owner Financing

The property seller acts as the lender, allowing the buyer to make payments directly to them over an agreed-upon period, bypassing traditional mortgage lenders.

Contract for Deed

This works just like owner financing with one extremely important exception - ownership doesn't change hands until the entire sales price is paid in full.

Seller Second

The seller extends a second mortgage or loan to the buyer in addition to the primary mortgage, providing additional funds to facilitate the property purchase.